Managing your business finances effectively isn’t just good practice—it’s the difference between thriving and barely surviving. Whether you’re launching your first side hustle or scaling an established business, smart financial management provides the foundation for stress-free growth and long-term success. In today’s digital landscape, the right financial management apps can transform how you handle money, automate tedious tasks, and give you real-time insights to make smarter business decisions.

This comprehensive guide cuts through the noise to showcase the best financial management, accounting, and budgeting apps available in 2025. You’ll discover tools that match your needs and budget, streamline your operations, and support your growth journey—all designed for entrepreneurs who need reliable, user-friendly solutions without requiring an accounting degree.

Why Financial Management Apps Matter

In the fast-paced world of entrepreneurship, financial management apps have become indispensable tools for business success. These digital solutions offer several critical advantages that can make or break your venture:

Improved Accuracy: Automated calculations and real-time data syncing eliminate human error, ensuring your financial records are precise and reliable.

Time Savings: Studies show that businesses using financial automation save up to 35,000 human hours annually on repetitive tasks like data entry, invoice processing, and reconciliation. This means more time for growth-focused activities.

Better Compliance: Automated systems help maintain regulatory standards with up-to-date, audit-ready records while reducing the risk of compliance violations.

Smarter Decision-Making: Real-time financial insights enable you to spot trends, identify cash flow issues early, and make data-driven decisions that drive profitability.

Stress Reduction: With automated reminders, streamlined processes, and clear financial visibility, you can focus on what you do best—growing your business—rather than drowning in paperwork.

Research indicates that 75% of successful businesses attribute their success to effective financial management. For small businesses and startups operating on tight margins, the efficiency gains from financial apps often mean the difference between success and failure.

All-in-One Accounting & Bookkeeping Apps

For entrepreneurs seeking comprehensive financial management solutions, these platforms offer robust features that can grow with your business.

QuickBooks Online: Best Overall for Comprehensive Features

QuickBooks Online remains the gold standard for business finance apps, used by millions of small businesses worldwide. Its comprehensive feature set and extensive integration ecosystem make it ideal for businesses that need a scalable, professional solution.

Key Features:

- Advanced invoicing with customizable templates and automated reminders

- Comprehensive financial reporting with over 65 pre-built reports

- Full payroll integration with tax filing capabilities

- Inventory management with low-stock alerts

- Time tracking and project management tools

- 650+ third-party integrations including major payment processors

Ideal For: Growing businesses that need comprehensive features, established companies requiring advanced reporting, and businesses with inventory or employees.

Pros:

- Most comprehensive feature set in the market

- Excellent customer support with phone, chat, and extensive resources

- Strong mobile app functionality

- Robust tax preparation tools

- Industry-leading security features

Cons:

- Higher cost compared to alternatives ($20-$235/month)

- Can be overwhelming for very small businesses

- Steeper learning curve for accounting novices

Current Pricing: Plans start at $20/month for the Solopreneur plan, scaling to $235/month for Advanced features. A 30-day free trial is available.

Xero: Best for Real-Time Collaboration and International Operations

Xero has earned recognition as one of the most user-friendly accounting platforms, particularly favored by startups and international businesses. Its clean interface and unlimited user access make it excellent for collaborative teams.

Key Features:

- Real-time bank reconciliation with automatic transaction matching

- Multi-currency support for international transactions

- Unlimited users across all pricing plans

- Project tracking with time and expense management

- 1,000+ app integrations including major e-commerce platforms

- Strong mobile apps for iOS and Android

Ideal For: SaaS companies, international businesses, collaborative teams, and companies with multiple users needing access.

Pros:

- Intuitive, clean user interface that’s easy to navigate

- Unlimited users make it cost-effective for growing teams

- Excellent for businesses with international operations

- Strong third-party integration ecosystem

- Reliable cloud-based access from anywhere

Cons:

- Limited phone support on basic plans

- Inventory management is basic compared to competitors

- Some advanced features require add-ons

Current Pricing: Plans range from $15-$78/month with a 30-day free trial available.

FreshBooks: Best for Invoicing and Service Businesses

FreshBooks prioritizes user experience above all else, making it the top choice for freelancers and service-based businesses who need powerful invoicing capabilities without complexity.

Key Features:

- Industry-leading invoicing with professional templates

- Built-in time tracking with billable hours management

- Client portal for seamless communication and payment

- Expense tracking with receipt capture via mobile app

- Project management with budget tracking

- Automated late payment reminders

Ideal For: Freelancers, consultants, creative professionals, and service-based businesses that bill by time or project.

Pros:

- Most intuitive interface in the industry

- Exceptional invoicing and client management features

- Strong mobile app functionality

- Excellent customer support with high satisfaction ratings

- Built-in time tracking saves money on additional tools

Cons:

- Limited advanced accounting features

- Higher per-user costs for teams

- Basic inventory management capabilities

- Limited financial reporting compared to competitors

Current Pricing: Plans start at $17/month for the Lite plan, scaling to $55/month for Select. All plans include a 30-day free trial.

Zoho Books: Best for Small Business Automation and Value

Zoho Books offers exceptional value with its comprehensive feature set and affordable pricing, particularly attractive for businesses already using other Zoho products.

Key Features:

- Automated workflows for recurring tasks

- Multi-user support with role-based permissions

- Comprehensive project management with profitability tracking

- Advanced inventory management with warehousing

- 50+ financial reports and custom report builder

- Integration with entire Zoho ecosystem

Ideal For: Small to medium businesses seeking automation, companies using other Zoho products, and budget-conscious businesses needing professional features.

Pros:

- Excellent free plan available for small businesses

- Strong automation capabilities reduce manual work

- Comprehensive feature set at competitive prices

- Good integration with other business tools

- Multi-currency and multi-language support

Cons:

- Fewer third-party integrations than QuickBooks or Xero

- Can be complex for very small businesses

- Learning curve for advanced features

Current Pricing: Forever free plan available, with paid plans from $15-$240/month depending on features needed.

Wave: Best Free Option for Budget-Conscious Beginners

Wave stands out as the only truly free accounting software that doesn’t compromise on core functionality, making it perfect for new entrepreneurs operating on tight budgets.

Key Features:

- Completely free core accounting and invoicing

- Unlimited income and expense tracking

- Professional invoice templates with customization

- Receipt scanning via mobile app

- Basic financial reporting

- Payment processing available for additional fees

Ideal For: New businesses with limited budgets, freelancers just starting out, and simple service businesses without complex needs.

Pros:

- Core features are completely free forever

- No limits on transactions or invoices

- Clean, easy-to-use interface

- Good mobile app functionality

- Solid customer support considering it’s free

Cons:

- Limited advanced reporting capabilities

- No phone support

- Advanced features like payroll cost extra

- Fewer integrations than paid competitors

Current Pricing: Free for core accounting features. Payment processing starts at 2.9% + $0.60 per transaction.

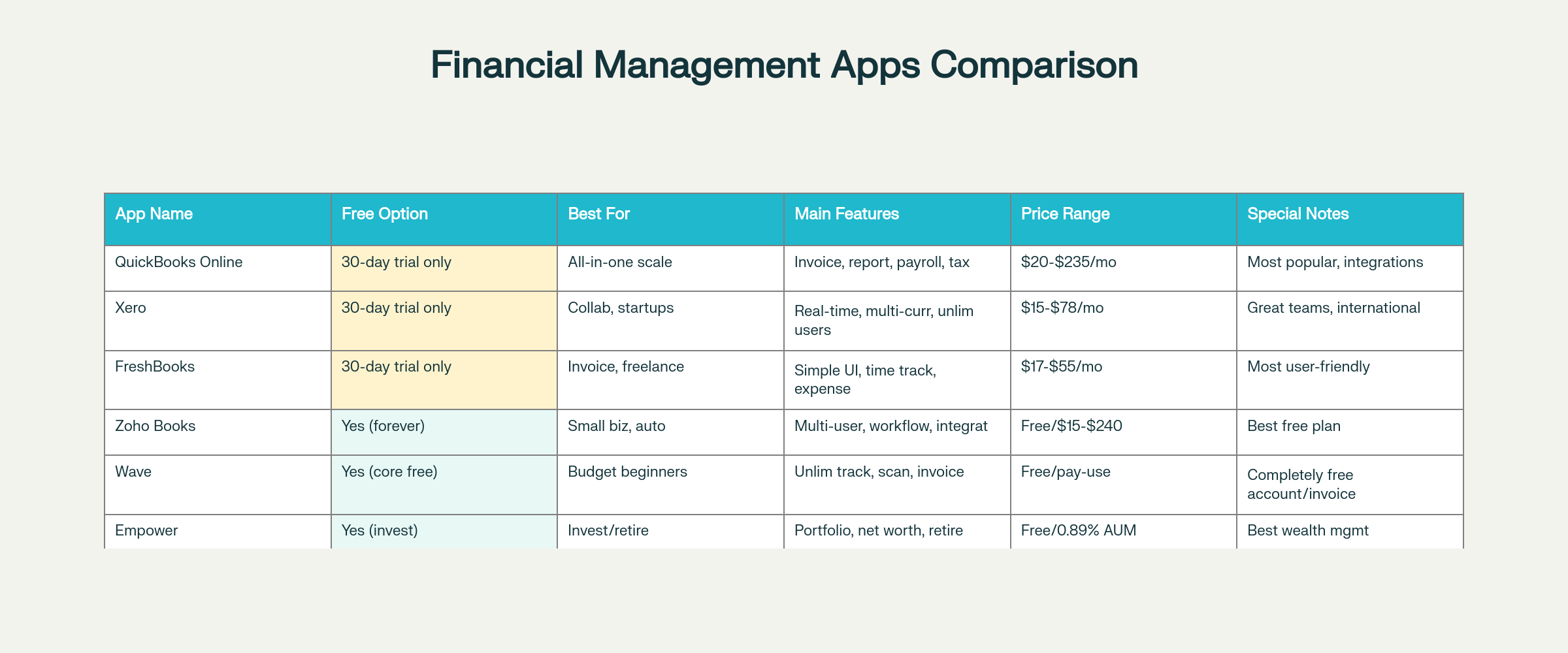

Essential Financial Management Apps Comparison for Entrepreneurs and Small Businesses

Budgeting & Expense Tracking Apps

For entrepreneurs who need powerful budgeting tools and expense management without full accounting complexity, these apps provide focused solutions for financial planning and tracking.

Empower: Best for Investment and Retirement Planning

Formerly known as Personal Capital, Empower excels at providing a comprehensive view of your financial life, combining budgeting tools with investment tracking and retirement planning.

Key Features:

- Personal financial dashboard showing net worth and cash flow

- Investment portfolio tracking with performance analysis

- Retirement planning calculator with goal setting

- Free budgeting and expense categorization

- High-yield cash account (3.75% APY)

- Wealth management services for larger accounts

Ideal For: Entrepreneurs building wealth, business owners planning for retirement, and those with investment portfolios to track alongside business finances.

Pros:

- Completely free investment tracking and budgeting tools

- Comprehensive view of all financial accounts in one place

- Professional wealth management available for larger accounts

- Strong security with bank-level encryption

- Excellent for long-term financial planning

Cons:

- Focuses more on investments than day-to-day business operations

- May contact you about paid services if you have substantial assets

- Limited business-specific features compared to accounting software

Current Pricing: Free for basic tools, 0.89% fee for wealth management services (minimum $100,000).

Credit Karma: Best Free Alternative to Mint

With Mint’s discontinuation in 2024, Credit Karma has become the go-to free budgeting solution, offering essential financial tracking with the added benefit of credit monitoring.

Key Features:

- Free credit score monitoring from two bureaus

- Spending and income tracking across accounts

- Net worth calculation and tracking

- Bill reminder notifications

- Basic budgeting and goal setting

- Identity monitoring services

Ideal For: Entrepreneurs who need basic budgeting and want to monitor their credit health, especially important for those seeking business loans or credit lines.

Pros:

- Completely free with no premium tiers required

- Credit monitoring helps maintain borrowing capacity

- Clean, simple interface that’s easy to navigate

- No impact on credit score to check

- Identity theft monitoring included

Cons:

- Limited advanced budgeting features

- Ad-supported model can be distracting

- Basic reporting compared to dedicated accounting software

- No business-specific features

Current Pricing: Completely free.

YNAB (You Need a Budget): Best for Teaching Budgeting Discipline

YNAB takes a unique approach to budgeting by teaching you to be proactive with your money, assigning every dollar a job before you spend it.

Key Features:

- Zero-based budgeting methodology

- Real-time syncing across all devices

- Goal tracking for both business and personal objectives

- Educational resources including workshops and tutorials

- Detailed reporting on spending patterns

- Account sharing for up to six people

Ideal For: Entrepreneurs who struggle with budgeting discipline, business owners who want to master money management principles, and those willing to invest time in learning proper budgeting.

Pros:

- Teaches sustainable money management habits

- Strong community and educational resources

- Flexible budgeting system that adapts to irregular income

- Excellent for both business and personal finance

- No ads or product recommendations

Cons:

- Requires significant time investment to learn and maintain

- No free version after trial period

- Steeper learning curve than other budgeting apps

- Monthly subscription fee may deter some users

Current Pricing: $14.99/month or $109/year after a 34-day free trial.

Tiller Money: Best for Spreadsheet Power Users

For entrepreneurs who love the flexibility of spreadsheets but want automated data feeds, Tiller Money combines the best of both worlds.

Key Features:

- Automated transaction syncing to Google Sheets or Excel

- Customizable spreadsheet templates for budgeting

- Bank-level security for data protection

- Monthly and annual budget tracking

- Custom reporting and analysis capabilities

- One-time setup with ongoing automation

Ideal For: Business owners comfortable with spreadsheets, entrepreneurs who need custom reporting, and those who want full control over their financial data structure.

Pros:

- Ultimate flexibility and customization

- Familiar spreadsheet interface

- Powerful analysis capabilities

- One low monthly fee for unlimited customization

- Works with Google Sheets and Excel

Cons:

- Requires spreadsheet knowledge to maximize value

- No mobile app (web-based only)

- Limited support compared to traditional apps

- Setup can be time-consuming initially

Current Pricing: $79/year with a 30-day free trial.

Niche Tools & Integrators

These specialized tools excel in specific areas of financial management, often integrating with your main accounting software to provide enhanced functionality.

Bill.com: Best for Invoice and Payment Automation

Bill.com transforms accounts payable and receivable into streamlined, automated processes, making it invaluable for businesses dealing with high volumes of invoices and payments.

Key Features:

- Automated invoice processing and approval workflows

- Electronic payment processing (ACH, wire transfers, virtual cards)

- Integration with QuickBooks, Xero, and other major accounting platforms

- Vendor management and 1099 preparation

- Approval routing with multi-level authorization

- Real-time cash flow visibility

Ideal For: Businesses with high invoice volumes, companies wanting to eliminate paper checks, and organizations needing structured approval processes.

Pros:

- Significantly reduces manual payment processing time

- Strong security features for financial transactions

- Comprehensive audit trails for compliance

- Excellent integration with popular accounting software

- Scales well with business growth

Cons:

- Higher cost makes it prohibitive for very small businesses

- Primarily focused on US-based businesses

- Learning curve for setup and optimization

- Per-user pricing can become expensive for larger teams

Current Pricing: Plans start at $45/month per user, scaling to $79/month for advanced features.

Expensify: Best for Team Expense Management

Expensify leads the expense management category with its AI-powered receipt scanning and streamlined approval processes, perfect for businesses with employees or frequent travel.

Key Features:

- SmartScan receipt capture with automatic data extraction

- Customizable approval workflows

- Integration with accounting software and credit cards

- Mileage tracking with GPS capabilities

- Corporate card programs with real-time controls

- Advanced reporting and analytics

Ideal For: Businesses with employees who incur expenses, companies with frequent travel, and organizations needing detailed expense reporting.

Pros:

- Industry-leading receipt scanning accuracy

- Reduces expense report processing time by 75%

- Strong mobile app for on-the-go expense capture

- Flexible approval workflows accommodate various business structures

- Excellent integration ecosystem

Cons:

- Not a complete accounting solution

- Per-user pricing can add up for larger teams

- Some advanced features require higher-tier plans

- Primarily US-focused with limited international features

Current Pricing: Plans start at $5/month per user with a free tier for basic use.

Payment Processors: Stripe, PayPal, and Square

While not traditional accounting apps, these payment processors offer essential financial tools that integrate with your business operations.

Stripe excels in online payment processing with developer-friendly APIs and comprehensive global payment support. It’s ideal for e-commerce businesses and those requiring custom payment solutions. Key benefits include support for 100+ payment methods, advanced fraud detection, and subscription management capabilities.

PayPal provides familiar payment processing with strong buyer protection and international reach. It’s particularly valuable for businesses serving consumers who prefer PayPal’s trusted brand. Recent additions include business financing options and cryptocurrency support for business accounts.

Square offers an integrated ecosystem combining payment processing with point-of-sale systems and business banking. It’s perfect for businesses needing in-person payment capabilities alongside online processing. Square’s expanded banking services now include instant access to funds and integrated business accounts.

Pricing: All three platforms use transaction-based pricing, typically ranging from 2.9% + $0.30 per transaction, with volume discounts available for larger businesses.

How to Choose the Right App

Selecting the perfect financial management app requires careful consideration of your specific business needs, growth plans, and operational requirements. Here’s a systematic approach to making the right choice:

Assess Your Business Size and Complexity

Solopreneurs and Freelancers should prioritize ease of use and invoicing capabilities. Wave or FreshBooks typically provide the best value, with Wave offering free core features and FreshBooks excelling in client management.

Small Businesses (2-10 employees) need more robust features like multi-user access and basic reporting. Zoho Books offers excellent value with its free plan, while Xero provides unlimited users across all plans.

Growing Businesses (10+ employees) require advanced features like inventory management, payroll integration, and comprehensive reporting. QuickBooks Online provides the most complete feature set, though Xero offers strong collaboration tools.

Evaluate Your Budget Constraints

Free Options: Wave provides the most comprehensive free features, while Zoho Books offers a generous forever-free plan. Credit Karma serves basic budgeting needs without cost.

Budget-Conscious ($15-30/month): Xero and Zoho Books provide excellent value in this range, offering professional features without premium pricing.

Full-Featured ($30+/month): QuickBooks Online and FreshBooks justify higher costs with comprehensive features and superior support.

Consider Integration Requirements

E-commerce Businesses should prioritize apps with strong shopping platform integrations. QuickBooks Online offers the most extensive ecosystem, while Xero provides solid e-commerce connections.

Service Businesses benefit from time tracking and project management features. FreshBooks excels here, while Zoho Books offers good project management at lower cost.

Businesses Using Multiple Tools should evaluate integration ecosystems carefully. QuickBooks Online offers 650+ integrations, making it most likely to connect with your existing tools.

Assess Automation and User Experience Needs

Non-Accountants should prioritize intuitive interfaces. FreshBooks leads in user experience, followed by Wave for simplicity.

Automation-Focused Businesses benefit from Zoho Books‘ workflow automation or Bill.com‘s payment processing automation.

Global Operations require multi-currency support and international features, where Xero excels.

Plan for Growth and Scalability

Consider not just your current needs but where your business will be in 2-3 years. QuickBooks Online offers the most room for growth, while Xero provides good scalability for collaborative teams. Avoid choosing based solely on current size—growing into limitations is costly and disruptive.

Comparison: Top Financial Management Apps

To help you make an informed decision, here’s a comprehensive comparison of the leading financial management apps based on their key strengths, limitations, and pricing structures.

Free vs. Paid Options Analysis

Best Free Options:

- Wave: Offers completely free accounting and invoicing with no transaction limits

- Zoho Books: Provides a forever-free plan suitable for small businesses

- Credit Karma: Free budgeting and credit monitoring

- Empower: Free investment tracking and basic budgeting tools

Best Paid Value:

- Xero: $15/month starting price with unlimited users

- Zoho Books: $15/month for comprehensive small business features

- FreshBooks: $17/month for superior user experience and invoicing

Feature Comparison by Business Type

For Freelancers and Solo Entrepreneurs:

- Winner: FreshBooks for ease of use and client management

- Budget Option: Wave for free core features

- Growth Option: Zoho Books for scaling capabilities

For Small Teams (2-10 people):

- Winner: Xero for unlimited users and collaboration

- Value Option: Zoho Books for feature-rich automation

- Comprehensive Option: QuickBooks Online for complete business management

For Growing Businesses (10+ employees):

- Winner: QuickBooks Online for scalability and integrations

- Collaboration Focus: Xero for team-based operations

- International Business: Xero for multi-currency and global features

Integration and Ecosystem Strength

Most Integrations: QuickBooks Online (650+ apps) offers the broadest ecosystem, making it likely to connect with any tool you use.

Best API Access: Xero provides excellent developer tools and API access, ideal for custom integrations.

Ecosystem Integration: Zoho Books works seamlessly with other Zoho products, perfect if you’re already in their ecosystem.

Next Steps: Your Financial Management Action Plan

Now that you understand the landscape of financial management apps, it’s time to take action. Here’s your step-by-step guide to choosing and implementing the right solution:

Week 1: Assessment and Shortlisting

Day 1-2: Analyze Your Needs

- List your current financial pain points

- Identify must-have features vs. nice-to-have features

- Determine your monthly budget for financial software

- Consider your team size and growth plans

Day 3-5: Create Your Shortlist

Based on this guide, shortlist 2-3 apps that match your needs:

- For comprehensive needs: QuickBooks Online + Xero

- For budget-conscious users: Wave + Zoho Books

- For service businesses: FreshBooks + Zoho Books

- For investment tracking: Empower + any accounting solution

Day 6-7: Sign Up for Free Trials

Start free trials for your shortlisted apps simultaneously to compare them directly with your real business data.

Week 2: Testing and Evaluation

Test Core Workflows:

- Set up your chart of accounts

- Create and send a test invoice

- Connect your bank account and import transactions

- Generate basic reports

- Test mobile app functionality

Evaluate User Experience:

- How long does each task take?

- Which interface feels most intuitive?

- How easy is it to find help when needed?

- Which app makes you feel most confident about your finances?

Week 3: Implementation and Setup

Choose Your Winner based on:

- Ease of daily use

- Feature completeness for your needs

- Integration with your existing tools

- Cost-effectiveness for your budget

- Quality of customer support

Set Up Properly:

- Import historical data if needed

- Configure your chart of accounts

- Set up bank connections and rules

- Create invoice templates and recurring bills

- Configure user access if you have a team

Week 4: Optimization and Training

Optimize Your Workflows:

- Create templates for common tasks

- Set up automation rules where possible

- Configure reporting schedules

- Establish backup and security procedures

Train Your Team:

- Document key processes

- Schedule training sessions for users

- Create quick reference guides

- Establish who handles what tasks

Ongoing Success Tips

Monthly Reviews: Schedule monthly reviews of your financial data to stay on top of trends and catch issues early.

Quarterly Optimization: Reassess your workflows quarterly and optimize based on what you’ve learned.

Annual Evaluation: Each year, evaluate whether your chosen app still meets your needs as your business has grown and changed.

Stay Updated: Keep your app updated and take advantage of new features as they’re released.

Conclusion: Take Control of Your Business Finances Today

Smart financial management isn’t just about keeping track of money—it’s about building the foundation for sustainable business growth and entrepreneurial success. The financial management apps highlighted in this guide represent the best tools available in 2025, each designed to solve specific challenges faced by aspiring online entrepreneurs, side hustlers, and small business owners.

Whether you choose the comprehensive power of QuickBooks Online, the collaborative strength of Xero, the user-friendly excellence of FreshBooks, the automation capabilities of Zoho Books, or the cost-effective simplicity of Wave, you’re taking a crucial step toward financial clarity and business success.

Remember: progress over perfection. Start with the app that best fits your current needs and budget. You can always upgrade or switch as your business grows and your requirements evolve. The most important step is to start—to move from manual, error-prone financial management to automated, accurate, and insightful financial operations.

Your action plan is simple:

- This week: Shortlist 2-3 apps based on your business needs

- Next week: Start free trials and test with your real data

- Within a month: Implement your chosen solution and establish new financial workflows

The entrepreneurs who thrive in today’s competitive landscape are those who master their finances early. By choosing the right financial management app and implementing it properly, you’re not just organizing your books—you’re setting the stage for scalable growth, informed decision-making, and long-term business success.

Don’t let another month pass with scattered receipts, late invoices, or unclear cash flow. Take control of your business finances today, and give yourself the clarity and confidence you need to build the business of your dreams.

Ready to transform your financial management? Start your free trials this week and discover how the right app can revolutionize your business operations, reduce your stress, and accelerate your path to entrepreneurial success.

This article is part of our “Tools & Resources for New Online Entrepreneurs” content cluster, providing actionable insights to help you build and scale your digital business with confidence.