Starting a business means navigating a landscape where understanding both upfront investment requirements and realistic profit expectations is crucial for success. With over 38% of startups failing due to underestimating costs and running out of cash, choosing the right business model based on clear financial metrics—especially insight into startup costs by business model—has never been more important. This comprehensive analysis examines seven popular online business models, providing entrepreneurs with the data needed to make informed decisions about their venture’s financial foundation.

Why Startup Costs and Margins Matter

The difference between a thriving business and one that struggles often comes down to two critical financial metrics: startup costs and profit margins. Startup costs represent your one-time, upfront investment needed to launch your business—everything from equipment and software to initial inventory and marketing. These costs determine how much capital you’ll need to get started and begin generating revenue.

Profit margins, on the other hand, reveal what you’ll actually keep from each sale after covering all expenses. Understanding both gross and net margins is essential for sustainable growth.

Gross vs. Net Margins: The Critical Distinction

Gross profit margin shows what remains after subtracting the direct cost of goods sold (COGS) from your revenue. For an ecommerce business selling a $100 product that costs $40 to produce and fulfill, the gross margin would be 60%. This metric helps you understand your pricing power and direct profitability per product.

Net profit margin goes deeper, accounting for all business expenses including marketing, overhead, taxes, and operational costs. Using the same example, if those additional expenses total $35, your net margin drops to 25%. This figure represents your true bottom-line profitability and determines whether your business model is financially sustainable.

The distinction matters because high gross margins can be misleading if operational costs aren’t controlled. A consulting business might achieve 80% gross margins, but excessive marketing spending could reduce net margins to just 15%.

Quick Reference Table – Startup Costs by Business Model and Average Profit Margins

| Business Model | Startup Cost (USD) | Gross Margin (%) | Net Margin (%) | Notes/Scalability |

|---|---|---|---|---|

| Service Business (Consulting, Coaching, VA) | $500–$5,000 | 60–90 | 15–35 | Low cost, high margin, very scalable. |

| Dropshipping | $1,000–$5,000 | 20–50 | 5–10 | Scalable, inventory-free, but lower margins. |

| Print-on-Demand | $50–$500 | 30–60 | 7–20 | Low cost, best with niche audience. |

| Digital Products | $0–$1,000 | 70–95 | 30–50 | Upfront creation, minimal ongoing expense, highly scalable. |

| Inventory-Based Ecommerce | $2,000–$10,000+ | 30–45 | 5–15 | Needs stock, storage, more complex ops. |

| SaaS/Software | $5,000–$100,000+ | 75–85 | 20–40 | High skill/cost, strong long-term ROI. |

| Handmade/Artisan Goods | $100–$500 | 50–75 | 8–20 | Scalable via batch/outsource; creative niche. |

Note: For Indian entrepreneurs, multiply USD figures by approximately 83 (₹41,500–₹4.15L for service businesses, ₹1.65L–₹83L for inventory-based ecommerce)

Deep Dive – What Drives Costs and Margins in Each Model

Digital Products: The High-Margin Champion

Digital products represent the gold standard for profit margins, with gross margins often exceeding 70-90%. Once created, digital products like online courses, ebooks, or software templates have minimal ongoing costs beyond hosting and payment processing. The startup investment ranges from virtually nothing to $1,000, covering content creation tools, basic website setup, and initial marketing.

The key advantage lies in scalability—selling your 100th copy costs essentially the same as selling your first. However, success requires significant upfront effort in product development and building an audience willing to pay premium prices for your expertise.

Service Businesses: Time-Based Excellence

Service businesses, including consulting, coaching, and virtual assistance, offer some of the most attractive financial profiles for new entrepreneurs. With startup costs typically under $5,000 and gross margins of 60-90%, they provide an excellent return on investment. The minimal overhead—often just a laptop, internet connection, and basic software—keeps costs low.

The challenge lies in scaling beyond personal time constraints. Successful service businesses eventually transition to productized offerings, team-based delivery, or premium consulting models to break through the time-for-money ceiling.

Dropshipping & Print-on-Demand: The Inventory-Free Trade-Off

These models eliminate inventory risk but come with margin trade-offs. Dropshipping typically achieves gross margins of 20-50% with net margins around 5-10%. The low startup costs ($1,000-$5,000) make entry accessible, but third-party fulfillment fees and increased competition compress profitability.

Print-on-demand offers slightly better margins (30-60% gross, 7-20% net) due to customization opportunities. Success requires strong branding and niche positioning to justify premium pricing above commodity alternatives.

Ecommerce with Inventory: The Complex Profitability Puzzle

Traditional inventory-based ecommerce demands higher initial investment ($2,000-$10,000+) and complex operations management. Gross margins typically range from 30-45%, but operational expenses often reduce net margins to 5-15%. Success requires careful inventory management, effective marketing, and operational efficiency to maintain profitability.

The model offers strong scaling potential but requires sophisticated forecasting and working capital management to avoid cash flow problems from excess inventory or stockouts.

SaaS/Software: High Investment, High Reward

Software as a Service represents the most capital-intensive option, with startup costs ranging from $5,000 to $100,000+ depending on complexity. However, successful SaaS businesses achieve impressive gross margins of 75-85% with net margins of 20-40%. The recurring revenue model and high customer lifetime value justify the initial investment for technically capable entrepreneurs.

The challenge lies in reaching product-market fit and achieving sustainable growth, with many early-stage SaaS companies running negative margins while building their customer base.

Artisan/Handmade: Creative Commerce

Handmade businesses require minimal startup capital ($100-$500) but offer solid gross margins of 50-75%. Net margins typically range from 8-20%, with success depending on efficient production processes and premium positioning. The key to profitability lies in batch production, outsourcing routine tasks, and building a strong brand that supports higher prices.

Direct-to-consumer sales through platforms like Etsy or personal websites typically yield better margins than wholesale relationships.

Hidden Costs and Margin Killers to Watch

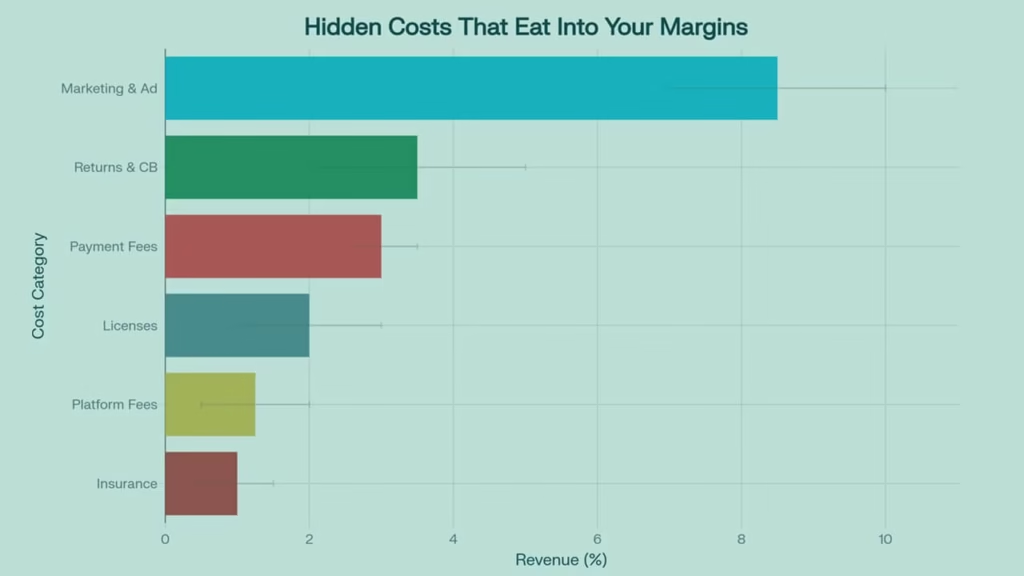

Hidden business costs that reduce profit margins, showing typical percentage ranges of revenue consumed

Even the most carefully planned business can face unexpected expenses that erode profitability. Understanding these hidden costs is crucial for accurate financial planning and maintaining healthy margins.

Marketing and Advertising: The Revenue Percentage Reality

Marketing typically consumes 7-10% of revenue, making it the largest hidden cost for most businesses. Digital advertising costs have risen significantly, with businesses spending between $301-$5,000 monthly on average. Customer acquisition costs (CAC) have increased by 50% over the past five years, particularly affecting SaaS and ecommerce businesses.

Successful businesses budget for sustained marketing investment rather than treating it as a one-time expense. The key is tracking return on ad spend (ROAS) and customer lifetime value to ensure marketing spend generates positive returns.

Payment Processing Fees: The Transaction Tax

Credit card processing fees typically range from 2.5-3.5% of transaction value, with additional costs for chargebacks, international transactions, and premium features. Popular processors like Stripe charge 2.9% + $0.30 per transaction, while alternatives like Helcim offer lower rates at 1.83% + $0.08 for in-person transactions.

These fees appear small individually but compound significantly over time. A business processing $100,000 annually at 3% fees pays $3,000 just for payment processing—money that directly impacts net margins.

Returns and Chargebacks: The Revenue Reversals

Returns and chargebacks can consume 2-5% of revenue, with ecommerce businesses particularly vulnerable. Chargeback fees typically range from $15-$100 per incident, plus the lost revenue and product. The average cost of fulfilling an ecommerce order is already 70% of the order value, making returns particularly damaging to profitability.

Effective return policies, clear product descriptions, and excellent customer service help minimize these costs while maintaining customer satisfaction.

Licenses, Legal, and Compliance: The Regulatory Reality

Business licenses and permits vary widely by location and industry. In India, basic business registration costs range from ₹100 for petty food businesses to ₹7,500 for central licenses. Legal and professional fees typically add $2,000-$10,000 annually, with compliance costs varying significantly by industry.

PCI compliance for payment processing, data protection requirements, and industry-specific regulations create ongoing costs that many entrepreneurs underestimate.

Platform and Website Costs: The Digital Infrastructure

Website hosting ranges from $89-$399 monthly for basic plans, with premium managed services costing significantly more. Ecommerce platforms like Shopify add monthly subscription fees plus transaction costs. Additional tools for email marketing, analytics, customer support, and automation can easily add $100-$500 monthly to operational expenses.

These costs scale with business growth, requiring careful evaluation of feature needs versus cost impact on margins.

Over-Optimism: The Planning Trap

Perhaps the most dangerous hidden cost is over-optimism in planning. Research shows that 38% of failed startups underestimated their costs and ran out of cash. Conservative planning with 6 months of operating expenses in reserve helps businesses navigate unexpected challenges and seasonal variations.

Decision Checklist—Which Model Fits Your Budget and Margin Needs?

Choosing the right business model requires honest assessment of your resources, skills, and goals. Use this framework to evaluate your options:

Assess Your Available Resources

Financial Capital: Determine your total available investment, including both startup costs and operating expenses for the first 6-12 months. Service businesses and digital products offer the lowest barrier to entry, while SaaS and inventory-based models require more substantial investment.

Time Investment: Consider how much time you can dedicate initially. Service businesses require immediate client work, while product-based models allow more flexible time allocation during development phases.

Technical Skills: Evaluate your ability to handle technical requirements. SaaS development requires programming expertise, while service businesses rely more on domain knowledge and communication skills.

Risk Tolerance: Determine your comfort level with uncertainty. Digital products and services offer more predictable costs, while inventory-based models involve demand forecasting and cash flow management complexities.

Calculate Your Financial Requirements

Bare Minimum Budget: Identify the absolute minimum investment needed to launch. This should include essential equipment, basic website setup, initial marketing, and 3 months of personal expenses.

Ideal Budget: Determine your optimal launch budget that includes quality tools, professional setup, substantial marketing budget, and 6+ months of operating expenses. This level typically produces better long-term results.

Break-Even Analysis: Calculate how many customers or sales you need monthly to cover basic expenses. This helps evaluate the feasibility of different models based on realistic market expectations.

Determine Your Income Timeline Goals

Quick Cash Flow: Service businesses and freelancing can generate income within weeks, making them ideal for entrepreneurs needing immediate revenue.

Medium-Term Growth: Ecommerce and digital products typically require 3-6 months to build momentum but offer better scaling potential.

Long-Term Investment: SaaS and subscription models may take 12+ months to reach profitability but provide the strongest recurring revenue potential.

Model Selection Strategy

Start Small, Scale Smart: Consider beginning with a lower-investment model (service/digital products) to generate capital for more ambitious ventures later.

Leverage Existing Skills: Choose models that utilize your current expertise to reduce learning curves and increase success probability.

Market Validation: Test demand through low-cost methods before committing significant resources to any model.

Hybrid Approaches: Many successful entrepreneurs combine models—offering services while developing digital products, or starting with dropshipping before building inventory.

Action Steps and Key Takeaways

Immediate Next Steps

Choose Your Top 2 Models: Based on your assessment, select two business models that align with your resources and goals. This provides a backup option if your first choice encounters unexpected challenges.

Create Detailed Financial Projections: Develop monthly cash flow projections for your first 12 months, including both optimistic and pessimistic scenarios. Include all hidden costs identified in this analysis.

Build Your Minimum Viable Budget: Calculate the smallest viable investment for your chosen model, focusing on essential elements that directly impact revenue generation.

Plan Your Revenue Milestones: Set specific monthly revenue targets and identify the customer acquisition activities needed to achieve them.

Essential Resources for Success

Financial Planning Tools: Use business planning software or detailed spreadsheets to track expenses and revenue projections. Many free templates are available through the SBA and business planning platforms.

Industry Benchmarking: Research specific metrics for your chosen industry to ensure your projections align with market realities.

Professional Guidance: Consider consulting with accountants, business advisors, or successful entrepreneurs in your chosen field for personalized guidance.

Continuous Learning: Join relevant online communities, attend industry events, and follow thought leaders in your chosen business model for ongoing insights.

Frequently Asked Questions

Can I Start with Zero Capital? While some models like digital products or services can launch with minimal upfront investment, most successful businesses require at least $500-$1,000 for basic tools, website setup, and initial marketing.

Which Model Has the Lowest Risk? Service businesses generally offer the lowest financial risk due to minimal startup costs and immediate income potential. However, they also face the challenge of scaling beyond personal time limitations.

How Can I Improve My Margins Over Time? Focus on operational efficiency, premium positioning, customer retention, and gradual price increases as you build brand value and customer loyalty. Regularly analyze your cost structure and eliminate unnecessary expenses.

Understanding startup costs and profit margins is your foundation for building a profitable business. By choosing a model that matches your resources and goals, planning for hidden costs, and focusing on sustainable margins, you’re positioning yourself for long-term success. Remember that the most successful entrepreneurs often start small, validate their markets, and reinvest profits into growth—a strategy that works regardless of which business model you choose.

The data shows clear winners in terms of margin potential, but success ultimately depends on execution, market understanding, and continuous optimization. Use this analysis as your starting point, but be prepared to adapt as you learn what works best for your specific situation and market conditions.

This article forms part of our series, “How to Choose the Right Business Model for You.” For further guidance on selecting a business model that fits your strengths and aspirations, be sure to explore the full series for actionable insights and expert advice.