Most new entrepreneurs, freelancers, and side-hustlers will never rely on a single paycheck again. Instead, they blend active income—the cash that shows up only when they work—with passive income that continues to flow long after the heavy lifting is done. Striking the right balance between passive vs active income streams is now a core survival skill: it cushions layoffs, funds growth, and accelerates the path to financial independence. This in-depth guide explains how active and passive streams differ, where each shines or falters, and how beginners can combine them for durable wealth in 2025.

Why the Choice Matters in 2025

Economic volatility, rapid automation, and the post-pandemic shift toward remote work have reshaped personal finance. A single employer or client can disappear overnight—as millions learned in 2020 and again during sector-specific downturns in 2024. Meanwhile, low-cost brokerage apps, creator platforms, and AI-powered tools have lowered the barrier to generating royalty, dividend, or digital-product revenue. The result is a mainstream push to cultivate at least one passive income stream while keeping a dependable active paycheck for day-to-day stability.

Yet confusion abounds. Viral videos promise “money while you sleep,” and tax myths circulate on social media. The reality is subtler: most passive income demands upfront sweat or capital, while active income offers predictability but caps earning potential. The sections below strip away hype and provide a practical roadmap you can act on today.

Definitions & Core Differences between Passive vs Active Income Streams

Plain-English Definitions

- Active income – Money earned directly from your labor: salaries, hourly wages, freelance contracts, consulting retainers, and service businesses. Stop working and the cash stops.

- Passive income – Earnings that continue after the initial build-out: rental checks, stock or REIT dividends, royalties from an ebook, affiliate commissions, or automated digital-product sales.

Active income buys groceries now; passive income plants seeds for future harvests. Most entrepreneurs need both to weather setbacks and scale faster.

Table 1. Examples of Active vs. Passive Sources

| Income Type | Example Sources |

|---|---|

| Active | Salary, freelance design work, sales commissions, hourly tutoring |

| Passive | Stock dividends, online courses, rental properties, print-on-demand royalties |

The distinction hinges on material participation—the IRS test that determines whether earnings are taxed as ordinary wage income or enjoy preferential capital-gains or dividend rates. Understanding that line keeps you compliant and can shave thousands off your annual tax bill.

The table above crystallizes the high-level contrasts entrepreneurs should memorize before choosing a new project.

Pros & Cons—Active vs. Passive Income

| Aspect | Active Income | Passive Income |

|---|---|---|

| Time/Effort Required | Ongoing, high | Upfront build, light upkeep |

| Earnings Potential | Predictable but capped by hours | Unlimited scaling after launch |

| Flexibility | Schedule-bound | Location- and time-free |

| Predictability | High (contracts, salary) | Market-dependent swings |

| Startup Investment | Often minimal | Ranges from none (digital) to sizeable (property) |

| Risk | Job loss, health setbacks | Market volatility, trend shifts |

| Tax Treatment | Ordinary income rates | Often lower capital-gains/dividend rates |

| Scalability | Limited—time = money | High—especially digital or financial assets |

Sources: SmartAsset , Investopedia , Magone CPAs

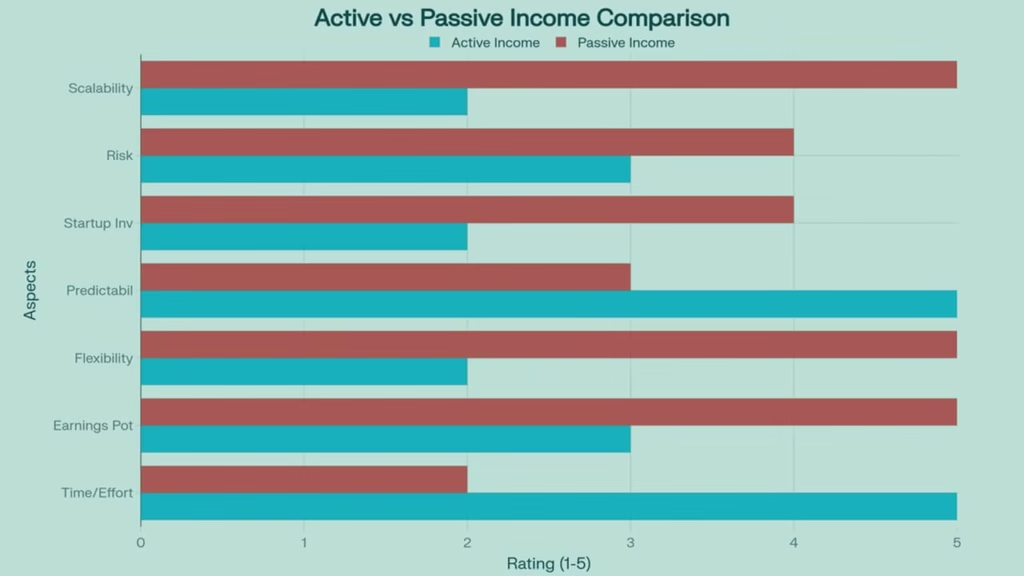

The horizontal bar chart visualizes those trade-offs at a glance. Notice how passive scores highest on scalability and flexibility, while active dominates predictability.

Interpreting the Data

- Time vs. Money Trade-Off – Active gigs pay sooner but lock you into hours. Passive plays front-load effort or cash but detach earnings from time later.

- Risk Profiles Diverge – Losing a single job can slash active income to zero; passive portfolios spread exposure across tenants, markets, or product lines. Conversely, market crashes can halve dividend checks while your consulting retainer keeps rolling.

- Tax Arbitrage – Qualified dividends and long-term capital gains top out at 20 percent federally (plus 3.8 percent net-investment surtax), whereas active wages can hit 37 percent plus payroll taxes. Smart structuring matters.

Choosing the Right Mix for Your Goals

Lifestyle Impact

- Active income advantages – Reliable cash flow, employer benefits, structured routine.

- Passive income perks – More free hours for family, travel, or scaling new ventures; pathway to early retirement (FIRE).

The sweet spot? Use active income to cover essentials and snowball a passive engine that eventually overtakes your living expenses. Surveys of FIRE adherents show most started with 50–70 percent savings rates from active pay to fund index funds or rentals, reaching “work optional” status in 8–15 years.

Financial Security & Diversification

Relying on one revenue vein is risky—ask any laid-off tech worker or restaurant owner during the last downturn. Diversifying across at least one active and one passive stream cuts that tail risk dramatically. Think of it as building a personal balance sheet instead of living paycheck to paycheck.

Tax & Legal Considerations

- Material participation tests decide whether rental losses offset wages or carry forward.

- Self-employment tax (15.3 percent) hits active freelance income but not pure dividends or long-term rents.

- Certain “passive” ventures (short-term Airbnb with services, active day-trading) are reclassified as active under IRS rules. Always confirm with a tax pro.

Common Myths vs. Realities

| Myth | Reality |

|---|---|

| “Passive income is effortless.” | All streams need upfront setup and periodic maintenance. |

| “It’s a get-rich-quick shortcut.” | Most take years to mature; early cash is modest. |

| “Active income is safer.” | One employer equals concentrated risk; blended streams offer resilience. |

Examples—What Counts in 2025?

Active Streams for Beginners

- Traditional employment (remote or onsite)

- Consulting/coaching retainers

- Gig-economy or contract projects

- Agency or service businesses (marketing, design, bookkeeping)

Passive Streams Gaining Traction

- Dividend stocks & index funds – Zero landlord headaches; automatic reinvestment ramps compounding.

- REITs & fractional real estate – Property exposure without direct management; yields 4–9 percent in 2025.

- Digital products – Online courses, templates, or apps sold 24/7 on platforms like Udemy or Shopify.

- Affiliate content sites – Niche blogs or YouTube channels monetized by referrals; low capital, high SEO skills.

- Print-on-demand merch – Tees, mugs, or planners with zero inventory risk.

- Peer-to-peer lending or bond ladders – 6–10 percent returns but higher default risk; diversify widely.

2025 Trend Watch

- AI-assisted content creation lowers production costs for digital assets, boosting margins.

- Tokenized real-estate shares on blockchain platforms democratize property access with as little as $100.

- Green-energy yieldcos and solar-panel leasing offer new dividend-style cash flows for eco-minded investors.

Action Steps & Decision Checklist

- Clarify goals – Immediate cash to quit debt? Target active freelance. Long-term wealth? Funnel surplus into index funds or rentals.

- Audit time & capital – Map weekly free hours and investable savings; pick streams that fit constraints.

- Start with two pillars – One dependable active gig + one scalable passive bet (e.g., weekend consulting + evergreen mini-course).

- Reinvest surplus – Channel active earnings into passive assets each month; automate transfers.

- Review annually – Track income ratios, tax impact, and burnout; rebalance if one stream dominates or drains energy.

Printable Checklist

- ☐ Emergency fund ≥ 6 months expenses

- ☐ Employer retirement match captured

- ☐ Selected first passive project (dividends / course / rental)

- ☐ Set automatic monthly contribution

- ☐ Scheduled quarterly passive-income review

- ☐ Consulted tax professional on classification

FAQs

Q: Can I live entirely on passive income?

A: Yes—but usually after years of building assets. Most beginners keep active work for stability while their passive streams grow.

Q: Which stream pays fastest?

A: Active freelancing or gig work; passive plays (courses, dividends) need lead time before noticeable cash flow.

Q: Do I need a lot of money to start?

A: Not always. Creating a $29 digital template or launching an affiliate blog can cost under $100; real estate obviously requires more capital.

Q: How are rentals taxed?

A: Net rental profit is ordinary income, but depreciation often shelters part of it; long-term gains on sale qualify for capital-gains rates.

Q: What if markets crash?

A: That’s precisely why you pair multiple streams—consulting income or a side-service business can offset a temporary dividend cut.

Conclusion

Active and passive incomes are not rivals but teammates. Active streams provide immediate cash, skill growth, and predictable budgeting. Passive streams unlock scalability, time freedom, and tax leverage. In 2025’s uncertainty, the entrepreneurs who thrive will combine both: protecting the present while stacking assets that pay forever. Start small, stay consistent, and review your mix each year—the road to financial resilience is paved with diversified income.

For deeper dives, explore our linked guides on choosing the best passive ideas, selecting side hustles, and mastering money management.

This article forms part of our series, “How to Choose the Right Business Model for You.” For further guidance on selecting a business model that fits your strengths and aspirations, be sure to explore the full series for actionable insights and expert advice.